Cryptocurrency / Blockchain

The details and even the concepts surrounding cryptocurrency are very hard for most people to understand. If you find yourself in a situation where you need legal assistance with issues involving cryptocurrency investments, call the Neumann Law Group today. We have developed a team of attorneys dedicated to the practice of law involving digital assets and can assist you in several areas.

If you are interested in the purchase and sale of cryptocurrency, have potential tax (IRS) issues related to your assets, or have experienced fraud, call us today for a free consultation. Due to the complex nature of cryptocurrency, other legal issues may arrive, and it is vital to have an experienced and detail-oriented advocate.

The History of Cryptocurrency and… What Is It?

Forms of cryptocurrency were developed as early as the 1980s with the introduction of electronic cash systems and attempts at government regulation have been pursued since the mid-90s. Our current models of cryptocurrency did not emerge until 2009 with the launch of Bitcoin. In an effort to limit the government or bank regulation of currency, Bitcoin was designed to serve as a way to exchange money through encoded computer networks. These networks do not rely on any regulatory agencies; however, recent developments have made cryptocurrency subject to federal securities laws.

In addition to understanding cryptocurrency itself, one must understand the blockchain. This is what ensures validity to each cryptocurrency coin. The ‘blocks’ are a list of records that are resistant to being modified. There are several other aspects involved with the process of purchasing, selling, and spending with cryptocurrency. Cryptocurrency does not exist in a physical form, rather are sold as digital ‘coins’. Those who purchase cryptocurrency coins are able to buy and sell them in networks that can resemble the stock market. There are many platforms that provide access to cryptocurrency and allow for proper management. It is widely believed that cryptocurrency is impenetrable to hackers and a safe place to buy and sell; however, nothing is bulletproof, including cryptocurrency storage.

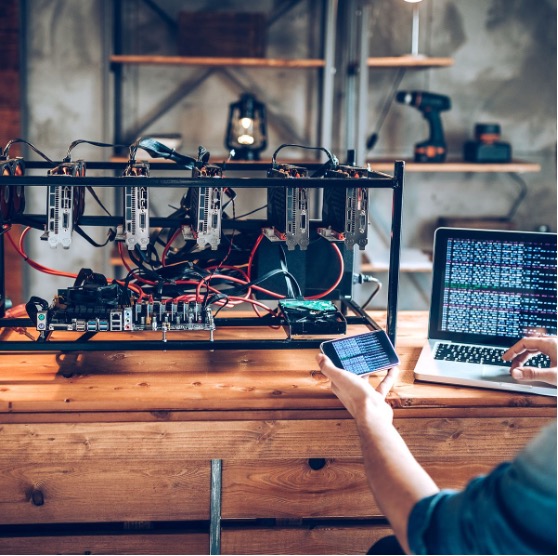

Cryptocurrency is created through a process called mining. Mining is kind of like a ‘digital treasure hunt’. Mining is used to secure and verify transactions on a cryptocurrency network. Those who mine cryptocurrency use massive computer networks to validate transactions from network users and solve complex math algorithms to prove their work, and the first one to solve it gets to add a new block of transactions to the network’s blockchain. In return for their efforts, miners are rewarded with newly created cryptocurrency. This is a crucial process to help secure blockchain networks, validate transactions, and create new units of cryptocurrency. Recently, concerns have come out regarding how mining consumes significant amounts of energy. These concerns have led to debates about its environmental impact and the sustainability of mining practices.

According to Jan Lansky from the University of Finance and Administration in Prague, a cryptocurrency is a system that meets six conditions:

- “The system does not require a central authority; its state is maintained through distributed consensus.

- The system keeps an overview of cryptocurrency units and their ownership.

- The system defines whether new cryptocurrency units can be created. If new cryptocurrency units can be created, the system defines the circumstances of their origin and how to determine the ownership of these new units.

- Ownership of cryptocurrency units can be proved exclusively cryptographically.

- The system allows transactions to be performed in which ownership of the cryptographic units is changed. A transaction statement can only be issued by an entity proving the current ownership of these units.

- If two different instructions for changing the ownership of the same cryptographic units are simultaneously entered, the system performs at most one of them”.

Although the United States government has no control over regulation of cryptocurrency, each State has made its own attempts at creating regulations. For example, Michigan is currently considering a bill which would create a “blockchain and cryptocurrency commission.”. The future of our regulation of cryptocurrency is unclear; however, it is important to acknowledge that there could still be legal implications for misuse.

How Can Neumann Law Group Help?

Individuals

More of the general population are showing interest in the ownership of cryptocurrency, mainly due to the fact that it is widely unregulated. If you don’t do your research and don’t understand the intricacies of buying and selling cryptocurrency, you may require guidance to avoid any illegal cryptocurrency activity.

- Cryptocurrency Tax Implications

The United States has classified cryptocurrency as ‘property’, not currency. You must be cautious in how cryptocurrency gains and losses are reported to the IRS. Individual taxpayers must record the price at which their cryptocurrencies were bought and sold and will be subject to capital gains tax laws with respect to profits. Further, cryptocurrency used as payment to you by your employer is to be considered taxable income. A person must be incredibly careful when filing their taxes after buying and selling cryptocurrency.

- Cryptocurrency Fraud and Recovery

Cryptocurrency owners may face fraudulent activity involving their purchase and sale of cryptocurrency, at no fault of their own. Hackers have gotten smarter and have figured out ways to penetrate the blockchain barriers. For example, they are often able to access this electronic information from gambling websites. They may also convince users to purchase currency that doesn’t even exist. Hackers can steal cryptocurrency, use it for money laundering purposes, or cause technical errors with their trading platforms. The most important thing to consider is that due to low regulation, cybercriminals can make their activities look like true income. An experienced cryptocurrency attorney can help you determine whether you have been the victim of fraud and can assist in determining not only where the fraud stemmed from, but also how to recover your assets. Your cryptocurrency attorney can also assist you in preventing any further fraud and loss on your behalf.

- Cryptocurrency Sale and Purchase

If you are interested in buying and selling cryptocurrency, it is important to know your rights and obligations in doing so. Neumann Law Group stays up to date with any regulatory changes. Our cryptocurrency attorneys can help you determine the best channel for purchase and sale and will ensure that you are following all requirements.

- Cryptocurrency Bankruptcy

Should cryptocurrency arise as a part of bankruptcy proceedings, one must be able to determine how the currency is included in the bankruptcy, how much it is worth, and how to be categorized in the case. All personal property must be disclosed in bankruptcy. Should a debtor fail to properly itemize their cryptocurrency on a bankruptcy petition, they could face legal penalty, including criminal charges in certain cases. An experienced cryptocurrency bankruptcy attorney can help properly record your assets, determine if your cryptocurrency is required to be reported, and help you avoid any future legal implications.

Businesses and Investors

The interest of businesses accepting cryptocurrency as payment for goods and services is on the rise. Just as individuals have certain rights and obligations with the sale and purchase of cryptocurrency, businesses and corporations can face more strict regulation and can potentially face severe legal consequences.

- Cryptocurrency Licensing

The process for a business to obtain the proper licensing to use cryptocurrency is difficult and many requirements must be met in order to obtain them. If you would like your business to have the ability to use cryptocurrency for the sale of goods, you must follow specific procedures, submit several forms, provide documentation, and do thorough research. It is highly recommended that you have an experienced cryptocurrency licensing attorney to assist and ensure that you are able to receive the proper cryptocurrency licensing.

- Cryptocurrency Regulatory Compliance

Although cryptocurrency is considered “unregulated”, this is not completely true. Many states are in the process of enacting laws and committees in order to do so. For example, Michigan is considering a bill that will establish a “blockchain and cryptocurrency commission”. Regulations will change over time, may become stricter, and require modification of business practices. Hiring a knowledgeable cryptocurrency attorney ensures that your business is up to date on all new and existing regulations and to keep your company in compliance. An attorney can ensure that all State and Federal requirements are met and will continue to work with your organization for its future success.

- Cryptocurrency Smart Contracts

Smart Contracts are a group of “promises” which are created from the blockchain and are kind of similar to a typical contract; however, they are maintained electronically and are thought to be tamper proof and secure. Smart Contracts govern the responsibility of both parties to a transaction fulfill their obligations. When one party upholds their end of the deal, they are immediately paid. An experienced cryptocurrency attorney can help ensure that your smart contracts are honored. If you have been accused of violating a contract, we will work to protect your interests in resolving any disputes. If your business would like to create a Smart Contract, we will also draft and review these contracts, again to ensure regulatory compliance. We will also make sure that these contracts will benefit your company and will lower any chance of legal impact. We can also apply for and file any necessary licensing on your businesses’ behalf.

- Cryptocurrency Money Laundering

A business that deals in cryptocurrency must “Know Your Customer”. Money laundering is becoming more prevalent in the cryptocurrency world. The ability for anonymous purchase of cryptocurrency allows criminals to use illicit money for purchase of cryptocurrency and the sale of illicit goods. Drug crimes involving the use of cryptocurrencies are becoming significantly more prevalent. Neumann Law Group cryptocurrency attorneys can help identify the origin and destination of illegal cryptocurrency exchange and assist in creating a more secure storage protocol.

- Cryptocurrency Intellectual Property

Some organizations may be eligible to pursue patents, trademarks, copyrights, and trade secrets with respect to their use of cryptocurrency. The purpose of applying for intellectual property protection is to protect any new technology or invention related to cryptocurrency. Protecting your work product is important, again due to the lack of regulation of cryptocurrency. It can be difficult to enforce these provisions because there are no specific laws in place to protect new innovations. Allowing for these protections will motivate further research and innovation in many different arenas, including healthcare and STEM industries.

- Cryptocurrency Tax Implications

Businesses and investors are required to file their taxes in a way that is quite different from individual filers; however, the reporting requirements for cryptocurrency is similar. All income is taxable, including that from cryptocurrency. Due to the limited guidance provided by the IRS, there are often major errors in filings, leading to audits and tax debt. Hiring an experienced cryptocurrency to evaluate your filings before submission is an invaluable resource.

- Cryptocurrency Investment and Initial Coin Offerings (ICOs):

Many investors looking to create new products or ideas can offer what is known as an Initial Coin Offering to other investors. The ICO is sold in the form of a digital ‘token’ and are purchased using cryptocurrency. Once the project is outlined to potential investors, the token is considered the investor’s “stake” in the project. Once the ICO period has ended, the funds from the cryptocurrency payments will be used for funding. Investors in these ICOs believe that the value of their token will increase as the project progresses. Should this value increase, the token can be sold back into the cryptocurrency exchanges. ICOs have decreased in popularity due to the heightened potential for fraud and project failure. Even though they are not as popular, ICOs still occur. If you are interested in investing in an ICO, call an experienced cryptocurrency attorney first. We can evaluate the ICO proposal, advise you on the risk vs. reward, and assist with creating fair and legal purchase agreements.

Cryptocurrency Data Theft and Financial Fraud

Despite the understanding that the blockchain is secure and anonymous, these systems are not impenetrable. Hackers have found ways to skirt the security measures and steal personal and financial data from cryptocurrency consumers. There have been massive data breaches, including a leak of 1 million email addresses by cryptocurrency wallet maker Ledger. This breach also included the full names, addresses, and phone numbers of several users. Security flaws have been identified in blockchains that could lead to the loss of millions of dollars. An experienced cryptocurrency attorney at Neumann Law Group can help you identify the breach, itemized your losses, and pursue restitution for your losses.

Cryptocurrency Litigation and Dispute Resolution

If it comes down to it, if you are in the need of an attorney to help you in Court for a cryptocurrency dispute, call Neumann Law Group. Our cryptocurrency trial attorneys are experienced in handling cases in court, always with the goal of settlement prior to going to court. We can take on accusations of fraud in cryptocurrency commerce, frozen accounts, cryptocurrency bankruptcy, cryptocurrency class action lawsuits, cryptocurrency breach of contract, and cryptocurrency negligent misrepresentations.

In addition to staying current with cryptocurrency regulations, Neumann Law Group’s attorneys are also skilled in intellectual property law, contract law, and business law. Being proficient in these areas are critical for a successful cryptocurrency attorney.

What Are Your Cryptocurrency Attorney Needs?

To summarize, Neumann Law Group can help with the following areas involving cryptocurrency for individuals, businesses, and investors:

- Tax Issues

- Regulatory Compliance

- Regulatory Changes

- Smart Contracts

- Initial Coin Offerings (ICOs)

- Intellectual Property

- Money Laundering

- Fraud

- Bankruptcy

- Sale and Purchase Agreements

- Litigation and Dispute Resolution

What Does Cryptocurrency Fraud Look Like?

Sam Bankman-Fried and FTX

Likely the most fraudulent failure in the cryptocurrency world came out of the negligence of Sam-Bankman-Fried, the founder of a cryptocurrency exchange called FTX. Mr. Bankman-Fried was found guilty of numerous financial crimes and was sentenced to 25 years in prison in November 2023. As one of the first cryptocurrency ‘titans’ he created a company valued at 30 million dollars; however, greed took hold, and he defrauded numerous investors, misused their funds, and basically took loans out against his users’ cryptocurrency. He used this money to fund his other businesses and did not make the effort to keep track of the money he moved. At the time of its collapse, FTX had an 8-billion-dollar gap between what should have been available to investors. Since Mr. Bankman-Fried was unable to obtain funding for this gap, FTX filed for bankruptcy. Once this was discovered by investors, it was too late. They were blocked from removing their funds from the FTX exchanges and billions of dollars were lost by customers and investors. Mr. Bankman-Fried used these funds to fund his other businesses, but also used it for luxury purchases, political donations, and advertising campaigns. The reality of another similar crash is a true concern in the financial industry. If you feel your cryptocurrency provider is acting in a fraudulent manner, call us.

Cryptocurrency Questions?

Cryptocurrency is a very complicated system and requires extreme attention to detail. The industry will continue to grow, and this article only skims the surface of how difficult it can be to properly buy and sell cryptocurrency at present. Those intricate details need to be evaluated quickly and our cryptocurrency attorneys are dedicated to staying up to date with current State and Federal regulations. Those who wish to begin using cryptocurrency and those facing legal issues related to their use of cryptocurrency should contact Neumann Law Group today at 800-525-6386 and allow us to evaluate your cryptocurrency needs.

- Link #1: https://www.researchgate.net/publication/322869220_Possible_State_Approaches_to_Cryptocurrencies

- Link #2: https://stevenscenter.wharton.upenn.edu/publications-50-state-review/

- Link #3: https://www.techtarget.com/whatis/feature/FTX-scam-explained-Everything-you-need-to-know#:~:text=FTX%20crashed%20due%20to%20mismanagement,of%20mishandled%20customer%20funds%20surfaced

- Link #4: https://www.neumannlawgroup.com/contact-us.html